Anna Von Reitz - Banks are Bankrupt

October 18, 2022

If promoting gender dysphoria, white replacement and cancelling conservatives

are not enough, Anna Von Reitz provides additional reasons why

we should not trust banks with our money.

From Sep 13, 2019

By Anna Von Reitz

(henrymakow.com)

Please be aware of the fact that all the banks are bankrupt by design and by definition. This is because of "fractional reserve banking" being practiced and allowed.

Fractional Reserve Banking is a fancy name for check kiting---writing more checks than you have assets to cover.

Banks are allowed to extend 7 to 10 times more credit than they hold as assets, and the assets they hold belong to depositors, so the banks have no skin in the game at all. They are bankrupt by definition from the get-go.

The credit they extend is not theirs to extend. It's yours.

They write checks based on your assets and credit themselves for this via check kiting, but since they keep the books, they get away with entering whatever digits they want to enter.

Bankruptcy is a patented business model that is necessary for this fraud to continue. Otherwise, those responsible for this situation would also be accountable for it. But as long as they can claim bankruptcy protection and risk nothing but their depositor's assets, they have no motivation to stop.

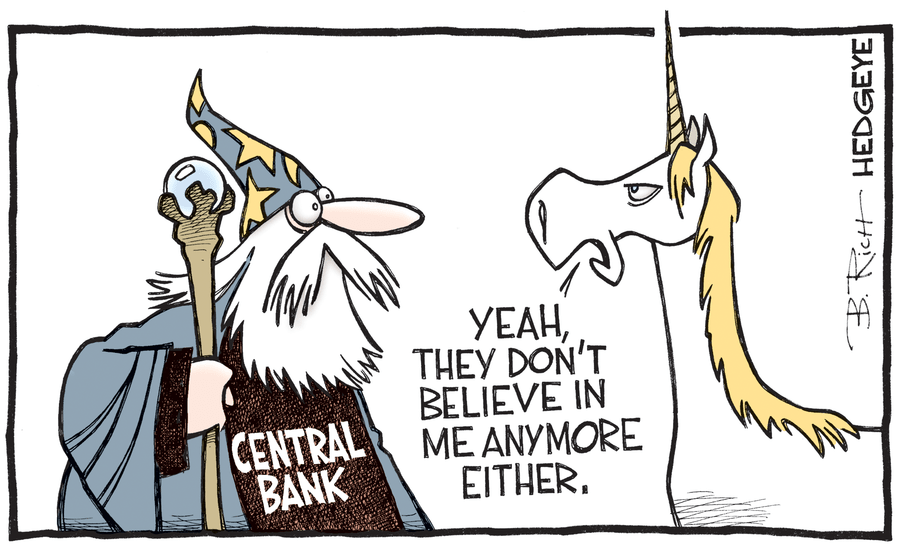

All the banks you see --- "central banks" and "retail banks" --- are bankrupt.

When they advertise "home loans" they are soliciting you to loan your home to them as an asset --- a deposit --- that they can borrow against.

They take your home as a deposit equal to its market value. They then use your asset as the basis to extend seven to ten times the loan amount as new credit to other victims.

They return the amount of the purported "home loan" to you, and you think that they have loaned you money, though in fact all you have received is a check --- a transfer instrument --- transferring "money of account".

("Money" is a con-fidence game)

Money of account is not actual money of any kind. It's just arbitrary digits entered in a ledger.

They also take a "security interest" in your home, as if they had anything at risk. And they force you to make monthly payments to repay THEIR loan, while they pocket the difference--- six to nine times the value of the check they kited on your credit. Plus interest, of course.

Above, find my favorite clip from Godfrey Bloom, member of Parliament, on this subject. In two minutes, his "hoary" speech, which he has delivered faithfully for years now, exposes the whole gambit:

Parliament does nothing about it. Congress does nothing about it. Until bankruptcy protection is denied and perpetrators are jailed, nothing will be done about it, because nobody is being held accountable for it.

If you are angry and outraged, you should be. You should stand behind Godfrey Bloom and me and everyone else who is fed up with this abject criminality.

A friend recently sent me a nice summary of case law demonstrating the fact that no National Bank can extend credit: "There is no doubt but what the law is that a national bank cannot lend its credit or become an accommodation endorser." (National Bank of Commerce vs. Atkinson, 55 Fed Rep 465)

"A national bank has no power to lend its credit." (Farmers & Miners Bank vs. Bluefield National Bank, 11 F2d 83, 271 US 669)

"Banking Associations from the very nature of their business are prohibited from lending credit." (St. Louis Savings Bank vs. Parmalee 95 U. S. 557)

"National Banks may lend their money but not their credit." (Norton Grocery vs. Peoples National Bank, 144 S.E. 501, 151 Va. 195)

So when you walk into a "National Bank" be aware that they have no capability to loan you any form of credit --- unless they are: (1) dealing in actual money, which none of them are; or (2) they are working in collusion with "central banks" to expedite the above-described credit fraud scheme.

What would you call an organization that loans credit based on someone else's assets and then charges the actual owner of the assets for the use of their own credit? Plus interest?

Godfrey Bloom and I would both call such an organization a crime syndicate. Most people call it a "Central Bank".

--------------

Related - Banking System Explains Our Woes

BR said (October 19, 2022):

re: https://henrymakow.com/2022/10/anna-von-reitz-banks-are-bankrupt.html

Fractional-Banking has been criminal firstly and mostly because it doesn't unwind the repaid principle sum.

All the details on balancing out the necessary dynamic, adaptive and distributed fractional reserve system:

https://netzerconsulting.wordpress.com/2019/10/05/corrected-fractional-reserve-system/

BTW:

There's not much utilitarian value in gold.

Gold is hardly distinguishable from Tungsten.

Gold is a sham scam although less than Crypto is.

Neither Gold or Crypto are directly attached to the vitality of a society, and if they were - it would only tarnish the logistics of money.

Recommendations-

1. The government can take from anybody everything at all, and we are on the precipice of a communist overtake in the West.

2. The least we could do is having all elected officials republican, and in earnest - being held accountable for it.

3. In the US also weapons, ammunition, a self-sufficient farm, a reliable Toyota with spare-parts and fixing gear,food-reserves, silver coins, stocks in big-tech and in weapons-makers. US cities are a 3rd-world dumpster on fire.