Mike Stone - Bitcoin is Midwife of CBDC's

March 11, 2024

Direct Link to Latest News

March 11, 2024

SA said (March 12, 2024):

I normally like reading Mike Stone's articles, but this newest article is very floored and I have to ask. What are his real intentions in trying to undermine Bitcoin? He uses a well worn lie and fallacy that the Dutch were bankrupted by the tulip craze when it really affected only a small and very wealthy part of the population. Your average Dutch citizen had nothing to do with it at all and it certainly did not cause the country into bankruptcy which sounds like lies and propaganda used as a Segway to then undermine Bitcoin.

Bitcoin is not of zero value like he states, you can't print it forever and ever like cash and it does not require a Government to regulate it (though they are trying) but more importantly it solves the very ancient problem of needing a trusted third party to perform a transaction.

This also solved the reversibility problem where a trusted third party could willingly or unwillingly reverse transactions. How he cannot see this or not have read this is staggering to me as I am just a regular Joe.

I don't own any so I am not writing this as a "true believer" I do have Etherium and a few other things that have done very very well though. I am sure there could be something nefarious behind blockchain and I have a number of well researched theories, but being of zero value is not one of them.

Tony B said (March 12, 2024):

Good God, Henry, WHEN will people do some homework on money? Stone is correct that bitcoin in a scam but everything else he writes here shows total ignorance of what is necessary for money to be money.

It's all common Rothschild miseducation promotion of their bullshit. I'm many years tired of trying to get people to do the homework on money. I'll just advise Stone and everyone else to spend some real time on a website of people who DO understand what necessitates true money: https://monetary.org/ home of Stephen Zarlinga's life work and those who keep trying to educate Americans on true money.

Thom Stone said (March 11, 2024):

Mike Stone is largely correct.

Bitcoin's origins have a strange genesis and it seems to have come from out of nowhere. Its timing during the financial crash nadir is peculiar as well. No one can even figure out who Satoshi Nakimoto is, but whoever developed the crypto technology behind BTC was probably given an offer he couldn't refuse by the CIA.

The two primary reasons Mr. Stone mentions as to why BTC receives so much attention is basically correct. First, if BTC did not exist, I estimate gold would $4,000-$5,000 an oz. Thus, BTC helps the central banks hide the monetary carnage by suppressing the gold price, while simultaneously deflecting attention away from gold as its traditional role as a barometer of financial decay.

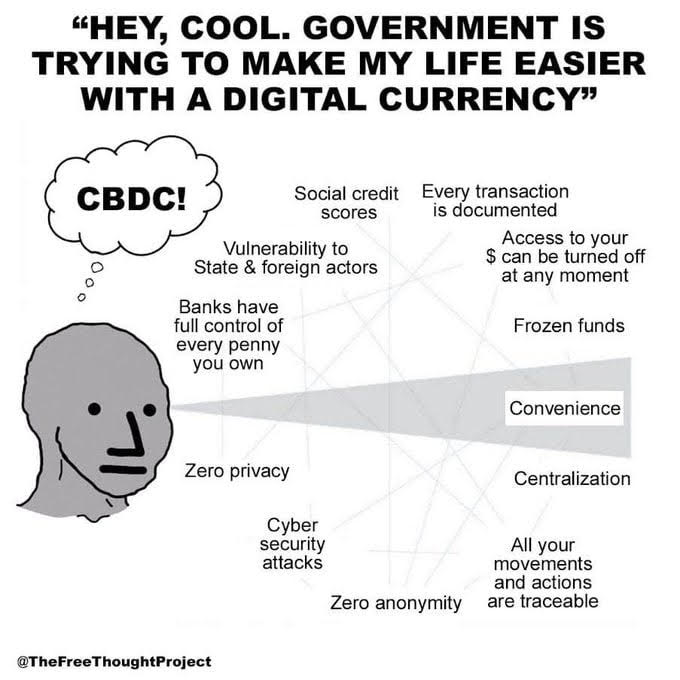

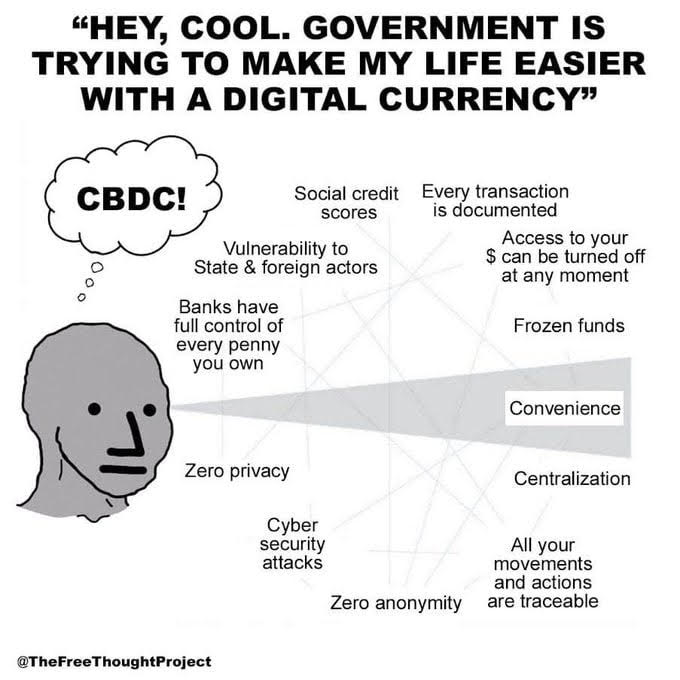

Second, BTC and its aggressive uptake by the masses greatly accelerates the CBDC timeline and eases the plebe's concerns about effectively losing their financial transaction freedom. BTCs underpinnings is easily tracked and traceable and there is absolutely no privacy. Every transaction ever taken place on its blockchain can be analyzed if necessary to prove who and where the funds flowed from and to. BTC is the perfect prototype for the NWO store of wealth, which replaced gold.

The only concept in which BTC fails as a transaction based currency is the fact that its price is highly volatile, while currencies are not. But the two can easily coexist in digital form.

Henry Makow received his Ph.D. in English Literature from the University of Toronto in 1982. He welcomes your comments at

AS said (March 12, 2024):

I agree 100% with Mike Stone about BTC being the midwife of CBDC - BUT to say that Bitcoin is based on nothing is incorrect

It is based on - A - hard capped limited stock to flow ratio - B - immutable and permanent transactions C- 100% reliable network D - Public information - all transactions are public since the beginning of the network E - The Moore's law value of the network (number of nodes)

I believe that BTC will be the harbinger for CBDC - BUT is will be in restoring the public trust temporarily with a fixed reliable asset to A - allow people to bridge into the new digital money and B - Allow themselves a chance to preserve their wealth while the transition happens