Larry Romanoff - The Cabalist Debt Scam: Rinse & Repeat

February 20, 2023

left, Jacob Rothschild and David Rockefeller

left, Jacob Rothschild and David Rockefeller As Catherine Austin Fitts has been saying,

the Cabalist central bankers create

a debt bubble and then burst it

by raising interest rates in order to

create a recession/ depression

so they can buy valuable assets on the cheap

The COVID scam

and economic downturn

fits this description.

by Larry Romanoff

(henrymakow.com)

It's not a secret that one of the nastier advantages of the private ownership of a country's central bank is that the Jews have total control over those economies.

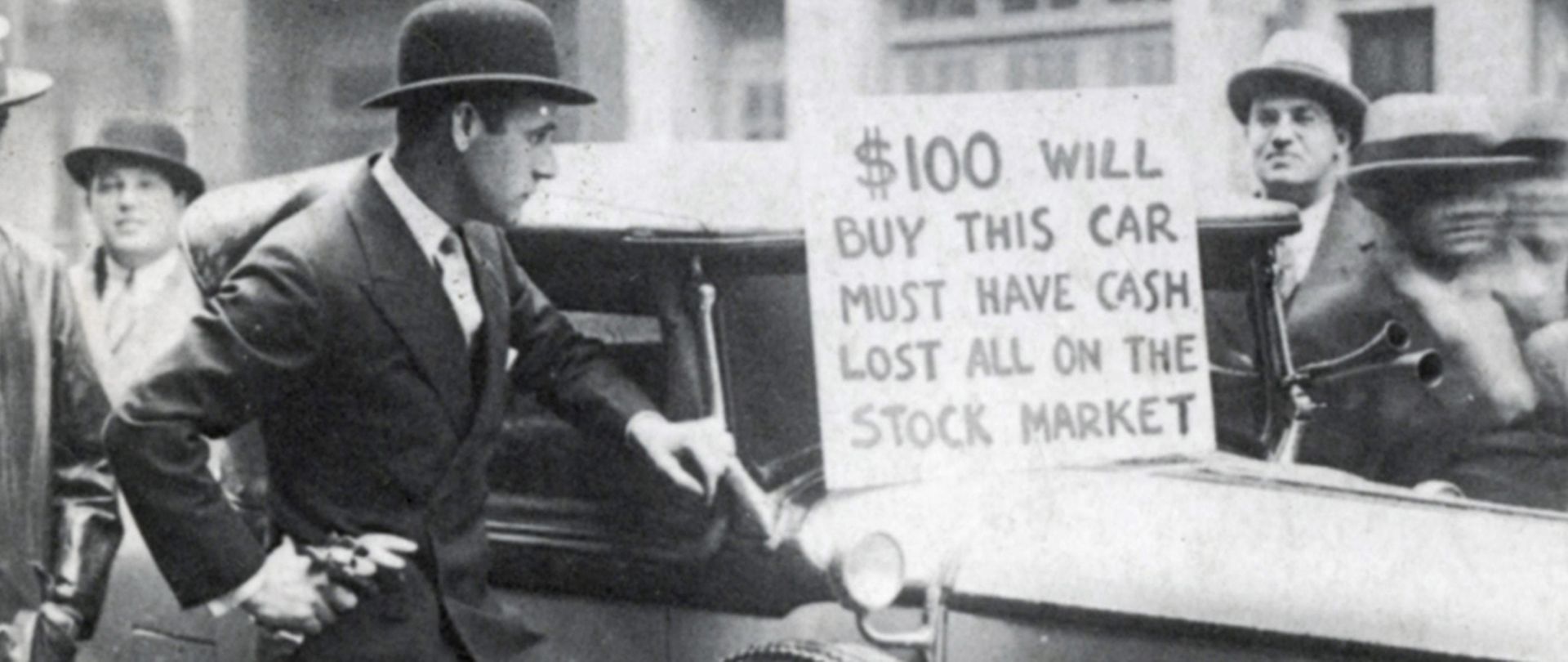

Since they control both the money supply and the interest rates, they have easily the power to whipsaw economies and profit immensely at every cycle. They do it the same way every time - by lowering interest rates to zero or nearly so, while hugely inflating the money supply and extending almost unlimited credit, thereby creating large bubbles in debt, in the stock and housing markets, and so on.

Then, they severely contract the money supply and all credit while simultaneously raising interest rates, thus bankrupting countless thousands of banks, businesses and families, and buying up for pennies on the dollar every manner of assets when the blood is running in the streets. It is also not a secret that all such recessions have been deliberately inflicted on Western economies by these Jewish bankers for the past 200 years or more. The 1929 collapse and the resulting Great Depression of the 1930s was only one such. This was done many times prior to 1929, and has been done many times since.

(left, Fed Chairman Ben Strong and Montague Norman)

(left, Fed Chairman Ben Strong and Montague Norman) At the beginning of the 1930s, the Khazar Jews in the City of London had just unleashed the most bitter recession in living memory. Montagu Norman, the head of the Rothschild-owned Bank of England, had a meeting with the Rothschild-owned FED and with the US Bankers Association, and shortly thereafter the entire world economy collapsed.

Senator Robert Owen, a co-author of the Federal Reserve Act, testified before a Congressional Committee that the bank he owned received a notice from the National Bankers' Association that stated: "You will at once retire one-third of your circulation and call in one-half of your loans."

And that is how Rothschild and these Jewish central bankers create recessions: an instant reduction of 35% or more in the nation's money supply and a 50% reduction in total credit. The inevitable result is the bankruptcies of thousands of corporations and banks, and an enormous plunge in stock market values and corporate assets of every description which are now available for purchase at pennies on the dollar. I covered the effects, including engineered recessions, of Jewish-owned central banks in a prior article titled, "Let's Have a Financial Crisis: First, We Need a Central Bank".[1]

Not only did the Great Depression require much advance planning prior to execution, but the activities during the recession were also daunting.

One source states that 1,100 US banks failed during the 1930s, while other sources claim "several thousand" banks failed. I have not researched these numbers but, even with the smaller figure, that is a huge number of banks to sort through in preparation for takeover - which was unquestionably one of the purposes of causing the Depression. But one cannot have other parties arriving first and cherry-picking the attractive assets, which means having many boots on the ground, filled with persons knowledgeable in banking and finance, and in law. I have no reliable confirmation of the number of those failed banks which were bought, stolen, merged, swallowed or absorbed, but it must have been a large percentage of the total in one form or another.

Banks do not become worthless simply because their circulating cash is withdrawn, and many, if not most, could have been made profitable again. Rothschild and his Khazar friends in the City of London certainly had access to all the banking information held by the FED, as well as access to similar information and data through the US Bankers Association, and would thus be privy to an enormous amount of confidential information on the state of each bank. However, buying up the cream of all those failed banks is not something we do with three or four people. The planning and execution would have involved quite a large number of "agents", even considering that J. P. Morgan was local and definitely a Rothschild agent, as were other Jewish banks.

But it wasn't only banks that were in peril during this time. As the Depression wore on, most corporations were experiencing various degrees of economic distress, and those producing goods with a high elasticity (unnecessary or luxury products or services whose sales fluctuate widely with economic conditions) experiencing the highest distress levels, making them ideal targets for cheap takeovers. As one example, Coca-Cola sales plummeted during this time, but the company miraculously survived and even absorbed competitors. It is entirely possible that one of the agents from the City of London purchased a controlling interest in the company at the time and, very often when this is done, the "Gentile Front" remains in position and the public never become aware of the actual change in ownership. Many companies exist today in this fashion, with the ultimate beneficial ownership totally masked by the existence of various kinds of trusts, offshore numbered companies, tax havens, investment funds, and many other mechanisms.

One company in this category that should attract our attention is General Motors. During the decade prior to the Depression, GM had lost enormous amounts of money, $65 million in one year alone and other large amounts in later years. From 1927 to 1933, sales of GM's main brands, Chevrolet and Buick, dropped by 50% and 80% respectively. There was no question GM was at the end of its rope and heading quickly for bankruptcy before the end of the 1930s. But then suddenly GM came to life with a vengeance and virtually remade the social and transportation landscape of North America. GM suddenly embarked on an incredibly-large program to kill all public transport in the US, buying up and scrapping the rolling stock of nearly 1,000 US railroads. I have covered this story with much detail in a prior article "Americans and Automobiles: Capitalism and Propaganda" [3] which contains much detail we haven't room for here.

One company in this category that should attract our attention is General Motors. During the decade prior to the Depression, GM had lost enormous amounts of money, $65 million in one year alone and other large amounts in later years. From 1927 to 1933, sales of GM's main brands, Chevrolet and Buick, dropped by 50% and 80% respectively. There was no question GM was at the end of its rope and heading quickly for bankruptcy before the end of the 1930s. But then suddenly GM came to life with a vengeance and virtually remade the social and transportation landscape of North America. GM suddenly embarked on an incredibly-large program to kill all public transport in the US, buying up and scrapping the rolling stock of nearly 1,000 US railroads. I have covered this story with much detail in a prior article "Americans and Automobiles: Capitalism and Propaganda" [3] which contains much detail we haven't room for here.But how could this happen? Do you have any idea how much money it would take to buy up all the electric locomotives and all the electric tram cars contained in 1,000 railroads? And this massive expense was not like the construction of a new factory that could be expected to produce high profits within a year, since nothing was done with the purchases. All that rolling stock was simply scrapped, and the money lost forever.

But GM was essentially bankrupt, so where would this money come from, to not only remain in production, but to embark on this extravagant venture that had any revenue or profit years in the future? The required sums would be enormous, extraordinary, and no one in the US had this kind of loose cash during the Great Depression, and certainly not to simply trash and throw it away.

The only source of funds of this magnitude would have been the Jewish bankers in the City of London. Since that time, GM has been essentially a criminal organization, specializing in money rather than automobiles, with an almost insane level of greed on occasion, exhibiting all the typical signs of Khazar/Mafia organized crime including bullying, extortion, fraud, deliberate quality degradation, and an astonishing contempt for the lives of its customers. I do not have documentary evidence that these Jewish bankers took ownership of GM at this time, but all signs are pointing in this direction, and all the facts fit the picture perfectly, especially in terms of GM's resulting character and business attitudes.