"A friend of mine who is a now a disillusioned high ranking member of the Jewish Freemasonry in Budapest has told me what is coming regarding the Greek crisis. Greece was chosen to play the role of the European Union bankrupt member state in order to "create" the big problem to which the European Union is going to "find" the "solution" soon...

The "only solution" soon to be proposed soon by the EU is to suppress the national fiscal and budgetary policies in Europe and have a centralized European budget. All European states will have to send most of their tax money to a central European government and the national budgets will be established by this central government too... it will mean that the European national governments will cease to exist."

1. Pillaging our assets and resources. Up to €50bn (£35bn) worth of Greek assets will be transferred to a new fund, which will contribute to the recapitalization of the country's banks.

The "valuable assets" include things such as planes, airports, resources, infrastructure and banks.

2. Reform of retirement age, cuts to pensions and increase of VAT to 23%. John Pilgar: Prime Minister Alexis Tsipras has pushed through parliament a proposal to cut at least 13 billion euros from the public purse - 4 billion euros more than the "austerity" figure rejected overwhelmingly by the majority of the Greek population in a referendum on 5 July. These reportedly include a 50 per cent increase in the cost of healthcare for pensioners, almost 40 per cent of whom live in poverty; deep cuts in public sector wages; the complete privatization of public facilities such as airports and ports; a rise in value added tax to 23 per cent, now applied to the Greek islands where people struggle to eke out a living. There is more to come."

3. Automatic spending cuts if targets aren't met.

4. EU officials in all ministries overseeing spending.

5. The new deal also calls for "more ambitious product market reforms" that will include liberalizing the economy with measures ranging from bringing in Sunday trading hours to opening up closed professions. Athens must "undertake rigorous reviews and modernization" of collective bargaining and industrial action.

6. Greece has been told to get on with privatizing its energy transmission network operator (ADMIE).

CONCLUSION

Ellen Brown has pointed out that the ECB could relieve the Greek debt by creating money. They are creating 60 billion euro every month as part of their quantitative easing program. Greek debt relief would amount to just one month.

But the goal of the central bank is not to solve Greece's problems but to exploit them in order to pillage the country. These bankers have been doing this for centuries. When they create money out of nothing, it returns to nothing when it is repaid. The banker prefers that countries default so they can get hard assets for their imaginary loan.

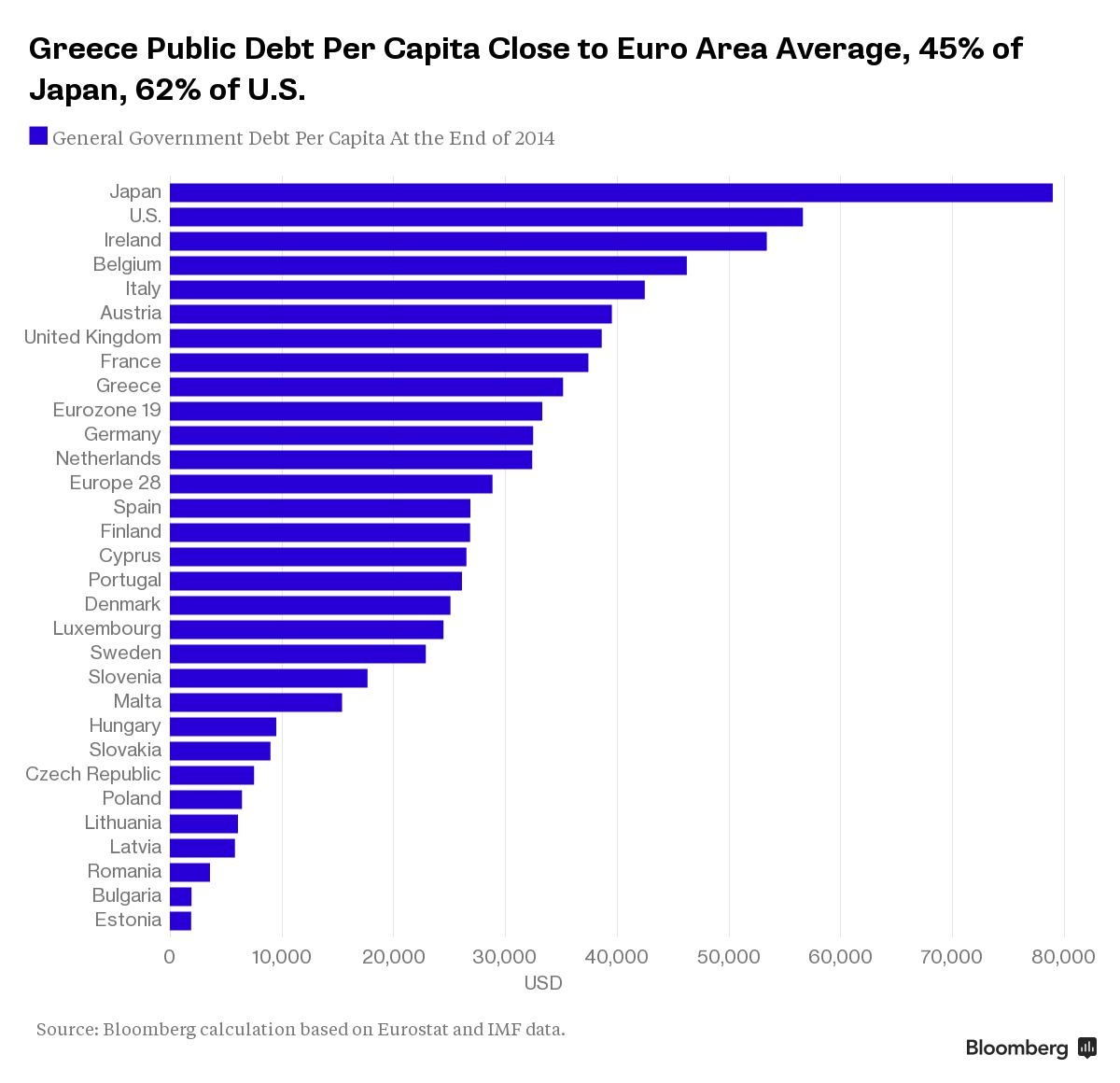

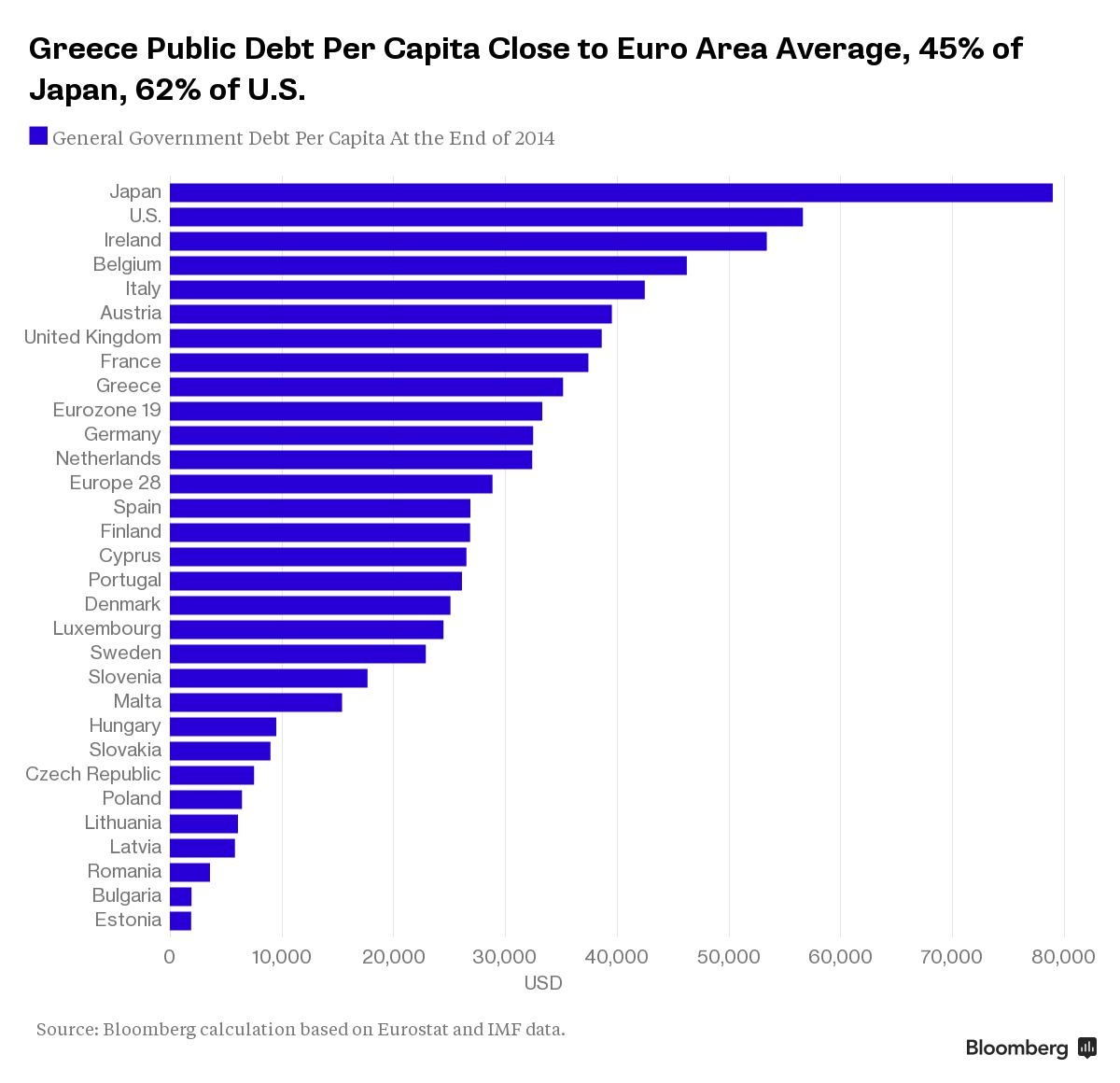

Our per capita debt is greater than Greece's. If our economies falter, the bankers will be at our door demanding their pound of flesh, and what little remains of our sovereignty.

------------------------------

Valuable Assets' are also national resources, like forests, oil and gas, even water. That's what the IMF and Word Bank has been doing to 'third world' "banana republics" all along.

It's a simple scam. I'll take the example of Mexico and Brazil in the late 1970's. The value of oil had inflated due to high demand leading to shortage. This was part of a chain of price manipulation dating back to the phony OPEC induced 'energy crisis' of 1974. By the end of the decade there were fantastic profits in tapping new wells Texas and Alaska, and the Gulf of Mexico. Economic hit men from the IMF and Chase Manhattan persuaded the Mexican government and elite to develop their offshore drilling capacity in the Gulf. That's how they induced them to go over their heads in debt. There's something about a 'boom', it's akin to 'gold fever'. It's like gambling addict. Let 'em win a few hands up front, they get greedy and forget the roll is temporary.

I was working in a bank in Houston when one morning we learned the Mexican peso had just dropped 60% in value overnight. Houston tax evaders with most of their money sheltered in Mexican banks were ruined, along with a lot of Mexican elite. I remember thinking, "My God, Chase Manhattan just foreclosed on Mexico." The losers are buried or lost to obscurity and life goes on for the winners. The digital wealth concentrates in a smaller clique of hands. This 'boom bust' pyramid scheme has been going on for over 240 years.

The point is, it's not the currency or even gold that matters, the end game is the real assets they represent. The entire exorcise has been necessary for the Cult to acquire the natural resources and land of all nations.

Al Thompso said (July 18, 2015):

The biggest problem with all the financial systems is usury or interest. Usury means the taking of any kind of interest; not just excessive interest. The way to fix the problem is to get rid of usury which is stealing. The other problem is the central banking system which holds a monopoly on the creation of money. Unless these problems are addressed then there is really no reason to expect any solutions for the benefit of the people. The banks exist for the benefit of the evil people. Of course, they don't really benefit as they bring upon themselves more trouble than any money is worth. Banking as we know it today produces boom and bust cycles and creates the conditions for war. With a monopoly on money the people become the slaves to the moneychangers.

http://verydumbgovernment.blogspot.com/2015/07/the-real-financial-problem-is-usury.html