Insider Confirmed Conspiracy is No "Theory"

October 16, 2014

Caroll Quigley (1910-1977) taught at Princeton, Harvard and Georgetown Universities. In his book, Tragedy and Hope, (1966) he confirmed that private merchant bankers create money out of nothing and control world affairs. He didn't mention social engineering but they are behind gender bending (feminism, homosexuality,) and sexual "liberation".

"There does exist, and has existed for a generation, an international Anglophile network which operates, to some extent, in the way the ... Right believes the Communists act. In fact, this network, which we may identify as the Round Table Groups, has no aversion to cooperating with the Communists, or any other groups, and frequently does so. I know of the operations of this network because I have studied it for twenty years and was permitted for two years, in the early 1960's, to examine its papers and secret records." Tragedy and Hope p. 960

Excerpts from Tragedy and Hope

Selected by henrymakow.com

Pg. 48-49:

In effect, this creation of paper claims greater than the reserves available means that bankers were creating money out of nothing. The same thing could be done in another way, not by note-issuing banks but by deposit banks. Deposit bankers discovered that orders and checks drawn against deposits by depositors and given to third persons were often not cashed by the latter but were deposited to their own accounts. Thus there were no actual movements of funds, and payments were made simply by bookkeeping transactions on the accounts.

(left, David Rockefeller, Jacob Rothschild)

(left, David Rockefeller, Jacob Rothschild) Accordingly, it was necessary for the banker to keep on hand in actual money (gold, certificates, and notes) no more than the fraction of deposits likely to be drawn upon and cashed; the rest could be used for loans, and if these loans were made by creating a deposit for the borrower, who in turn would draw checks upon it rather than withdraw it in money, such "created deposits" or loans could also be covered adequately by retaining reserves to only a fraction of their value. Such created deposits also were a creation of money out of nothing, although bankers usually refused to express their actions, either note issuing or deposit lending, in these terms. William Paterson, however, on obtaining the charter of the Bank of England in 1694, to use the moneys he had won in privateering, said, "The Bank hath benefit of interest on all moneys which it creates out of nothing." This was repeated by Sir Edward Holden, founder of the Midland Bank, on December 18, 1907, and is, of course, generally admitted today.

Pg. 51: The merchant bankers of London had already at hand in 1810-1850 the Stock Exchange, the Bank of England, and the London money market when the needs of advancing industrialism called all of these into the industrial world which they had hitherto ignored. In time they brought into their financial network the provincial banking centers, organized as commercial banks and savings banks, as well as insurance companies, to form all of these into a single financial system on an international scale which manipulated the quantity and flow of money so that they were able to influence, if not control, governments on one side and industries on the other.

The men who did this, looking backward toward the period of dynastic monarchy in which they had their own roots, aspired to establish dynasties of international bankers and were at least as successful at this as were many of the dynastic political rulers. The greatest of these dynasties, of course, were the descendants of Meyer Amschel Rothschild (1743-1812) of Frankfort, whose male descendants, for at least two generations, generally married first cousins or even nieces. Rothschild's five sons, established at branches in Vienna, London, Naples, and Paris, as well as Frankfort, cooperated together in ways which other international banking dynasties copied but rarely excelled.

Pg. 52: The names of some of these banking families are familiar to all of us and should be more so. They include Raring, Lazard, Erlanger, Warburg, Schroder, Seligman, the Speyers, Mirabaud, Mallet, Fould, and above all Rothschild and Morgan. ...

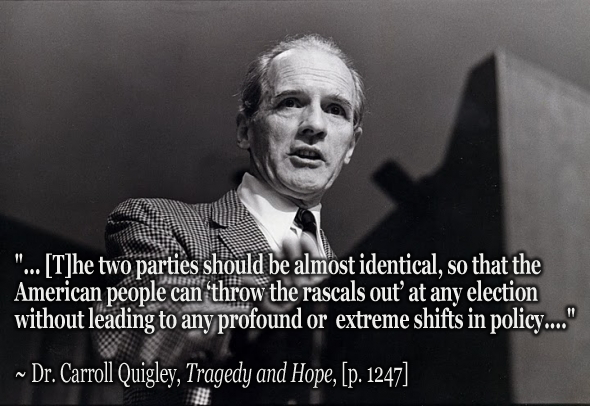

Pg. 324: The powers of financial capitalism had another far-reaching aim, nothing less than to create a world system of financial control in private hands able to dominate the political system of each country and the economy of the world as a whole. This system was to be controlled in a feudalist fashion by the central banks of the world acting in concert, by secret agreements arrived at in frequent private meetings and conferences.

Pg. 324: The powers of financial capitalism had another far-reaching aim, nothing less than to create a world system of financial control in private hands able to dominate the political system of each country and the economy of the world as a whole. This system was to be controlled in a feudalist fashion by the central banks of the world acting in concert, by secret agreements arrived at in frequent private meetings and conferences. The apex of the system was to be the Bank for International Settlements in Basle, Switzerland, a private bank owned and controlled by the world's central banks which were themselves private corporations. Each central bank, in the hands of men like Montagu Norman of the Bank of England, Benjamin Strong of the New York Federal Reserve Bank, Charles Rist of the Bank of France, and Hjalmar Schacht of the Reichsbank, sought to dominate its government by its ability to control Treasury loans, to manipulate foreign exchanges, to influence the level of economic activity in the country, and to influence cooperative politicians by subsequent economic rewards in the business world.

Pg. 326-327: It must not be felt that these heads of the world's chief central banks were themselves substantive powers in world finance. They were not. Rather, they were the technicians and agents of the dominant investment bankers of their own countries, who had raised them up and were perfectly capable of throwing them down. The substantive financial powers of the world were in the hands of these investment bankers (also called "international" or "merchant" bankers) who remained largely behind the scenes in their own unincorporated private banks. These formed a system of international cooperation and national dominance which was more private, more powerful, and more secret than that of their agents in the central banks.

---

First Comment by Dan:

For those who are just hearing of Carroll Quigley, here's additional information to underscore the value of his revelations.

Bill Clinton studied with Quigley atthe School of Foreign Service at Georgetown. (He got a 'B'). Clinton mentioned Quigley as a mentor in his 1992 Presidential nomination acceptance speech at the Democrat National Convention in 1992. (it was televised).

Quigley was not a whistle blower. He was just so enthusiastic about the New World Order that he didn't understand that the American public would be shocked if he'd had the ability and backing to write a best seller in 1966. As it happened the first edition of Tragedy and Hope was yanked from the shelves shortly after publication. It's my understanding that the publisher not only destroyed recalled copies, they destroyed the printing plates too. The second half of the original was put out in 1968. The editor cut everything prior to 1939. An abridged edition went out in 1975.

The book didn't raise the slightest blip in mass market consciousness because Quigley lacked talent as a story teller. He wrote in long runon sentences, digressing and meandering to the extent that reading him requires great patience. HIs books finally got on the radar as millions of people in the 1990's began to realize that George H W. Bush wasn't kidding in his 'New World Order' speech on September 11th, 1991.

Robert K said (October 17, 2014):

The essential nature of a sane money system is that it is an order system, a means of facilitating economic activity. However, the current one has been perverted to become a means of total societal control, mediated through the idiotic notion that in order that they should be privileged to live people must "work" eight hours a day for 30 or 40 years,

If people can't see that having resources of materials, manpower and technology sit idle because "there isn't enough money to put them to use" while their infrastructure falls apart and foreign interests buy up their country is sheer lunacy, and toss out politicians at all levels who are fronting for the financial racketeers, there would appear to be little hope of reforming the money system so it will serve rather than dominate.

How in the world could the concept of democracy have any relevance in a situation such as that described by Prof. Quigley?