Islamic Banking Seeks Ethical Partnerships

October 14, 2013

Islamic banking rejects interest-based loans

as being predatory and unfair.

by Samir Abid Shaikh

(henrymakow.com)

(Samir Shaikh is the Ex. Secretary General of The International Association of Islamic Banks)

The simplest way to define Islamic Banking is to say that : it is banking practiced according to the teachings of the religion of Islam .

Islamic banking is a form of banking that is harmonious with the goodness of humanity on Earth. The goodness in four different spheres : man to God , man to man , man to creatures of soul i.e. animals of all kinds , and man to inanimate creatures, i.e. nature.

In money matters such as trade , investments, and banking - the salient feature of goodness is manifested in the virtue of justice. In other words, when people deal in material objects, these dealings have to be fair to all parties concerned.

Islamic banking is supposed to be based on fairness and justice to all parties concerned, the bank as well as the public who use the service. One major obstruction of justice is usury which is manifest in the interest-based financial system.

One simple rule of detecting usury in Islamic teaching is that "Any loan that stipulates benefits to the loaner is a form of usury".

Most people borrow because they are in need , and need in itself is hurtful to human dignity. So to force people in need to pay penalties for their need is the epitome of inhumanity. This banning of the interest mechanism is therefore the cornerstone of Islamic banking.

HISTORY

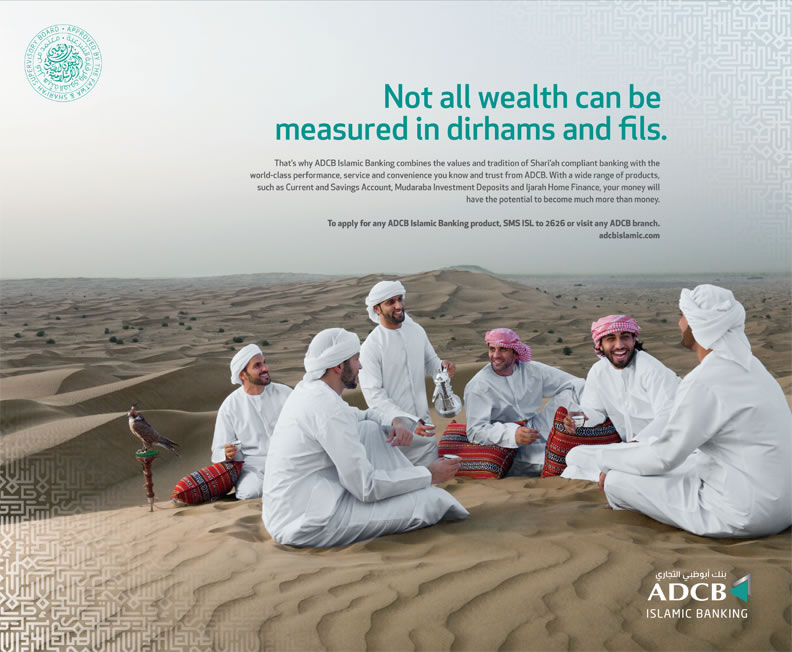

The first private Islamic Banks was established in Dubai of the United Arab Emirates in the year 1975 ; while the first government Islamic bank was initiated in Jeddah , Saudi Arabia during the same year. There are currently more than six hundred Islamic Financial Institutions worldwide. 50% of these Institutions are banks while approximately 25% each are Investment companies and Insurance Companies.

Most of the Islamic Financial Institutions started up in the Middle East Area. And the ones which have the most assets are those in the Arabian (Persian) Gulf Region . The total assets of all Islamic Financial Institutions had passed the one trillion dollar threshold. The whole movement of Islamic Banking is growing at the average rate of at least 9% a year. Wealthier Islamic countries have more Institutions sprout every year , while less developed Islamic countries obviously show less new institutions every year.

Islamic Financial Institutions have many challenges, the most serious of those is to remain true in spirit to Islamic and ethical principles. I think the waves of globalization and international finance have such strong influence on Islamic finance , that it tries to suck it within its sphere.

To be specific , Islamic financial institutions are faced with the issue of religious opinion versus legal systems in the countries where they operate. Another challenge is the supervision of central banks , which are interest based institutions. The third challenge is cooperating with interest based banks. A fourth challenge is using the benchmark of the LIBOR - London Interbank Offered Rate i.e. interest rate.

A new geopolitical challenge that surfaced during the last decade was the negative global Islamic image equating Islam with Terrorism . Unfortunately this is still going on , because of many global factors which might take decades to resolve. I hope that people can Isolate Islamic finance from insane terrorist acts regardless of the perpetrators are.

HOW ISLAMIC BANKING WORKS

HOW ISLAMIC BANKING WORKS This banning of the interest mechanism is therefore the corner stone of Islamic banking.

Let's take an example of the unfairness of the interest mechanism . Let's assume that a simple home owner takes a loan from a bank to finance his family home at 7% per annum interest.

Most home loans are obviously long term loans i.e. 15-30 years long. Interest rates change over time. If the interest rate goes up say to 10% or more, the home owner will be in great difficulty to make his payments.

Very often , home owners are forced to leave their homes for the banks to repossess. They often discover they don't own much of the home then , because most of their payments went to interest . This is how such mechanism is utterly unfair to people.

The risk here is mostly born by the homeowner, who is the weaker ring in the chain, rather than the bank which is the stronger side in this inequitable equation.

The unfairness is clear because the risk here is born by the weaker home owner rather than the bank. Ideally speaking, the risk should be shared by both, which is manifest in a form of finance offered by Islamic banks. Let me give an example here for another home owner who took financing according to Islamic principles.

Home financing by Islamic banks is often executed according to a contract called "decreasing partnership". This simply means that once a person finds a suitable home for his/her family, the bank is called in to finance it . The bank becomes a part owner of the house for an extended period of time. At the same time the bank gives the individual the right to purchase the house gradually so that at the end of the period , the individual owns the whole house.

But say, the individual's circumstances have changed , and has to move to another part of town or a different State , or wants to buy a newer house, then the house is put for sale and whatever the selling prices is, the bank and individual share according to their ratios of ownership at the year of sale. This way the contract is more fair to both sides. The risk in this case is born by the bank as well as the beneficiary of finance.

There are obviously several types of contracts which cater to different needs of financing. Contracts which suit trade, other which suit leasing , others for manufacture as well as agriculture. And there are a lot more details to contracts, but I hope this example gives a clear illustration of the difference between interest based and Islamic finance.

I certainly hope we will see this type of banking spread all over the world - and not necessarily having such a name .. because Islamic banking is really for all religions and people .

--

I asked Samir: How do Islamic banks make a profit?

Islamic Banks do make profits , but it is not necessarily pro rata to current interest rates. For instance one of their contracts is a form "partnership" . In this contract the bank partners with a business person to finance whatever venture they agree on . When the business person makes profit , the Islamic bank makes profit as well.

Another contract is a "Lease" contract where they lease aircraft or heavy equipment to industrial plants. such contracts specify the returns the bank gets on the lease. this return covers the bank's operational expenses in addition to a margin of profit.

Therefore, Islamic banks are profit making firms , but their contracts if properly applied strive to be fair and share the risk with the other side. For instance if during a partnership agreement , the market falls or due to unforeseen environmental disruptions, the project looses - then the bank share the losses.

--

Samir Shaikh is the author of "The Anatomy of Usury: A Critique of the Interest Based Economic System"

He replies to some of the comments below here. https://henrymakow.com/2013/10/islamic-banking-samir-shaikh-a.html

--

First Comment from Adrian:

According to the highly intelligent and amusing "fundamentalist Islam" writer and former banker, Syed Akbar Ali, there is no such thing as Islamic Banking. Quote:

From the article "..because the Muslims don't know.." :

"Islamic banking or Islamic finance exists because the religious folks have successfully inculcated the idea that bank interest is riba and therefore haram. The Quran states clearly that riba is haram but nowhere can we derive the injunction that bank interest is riba. The two are not the same. "

Syed has written many such articles. Another: "If Its Not Cheaper How Is It Islamic Banking?"

Anyone wishing to be informed about Islam, as opposed to Arab tribal culture, should check out Syed.

Jordan writes:

An Islamic banking insider explodes many myths about the industry here.

As an educated American Muslim convert, I do agree fundamentally that the method of banking established by God in the Qur'an and practiced by all of the prophets (peace be on all of them) is the best method of commerce possible.

The community established in Medina quickly proved it's effectiveness as Islamic traders established an empire spanning from China to Spain, invigorating local economies and establishing cities with public baths, libraries, and lit streets while Paris and London groveled in the dark in thatched huts on muddy river banks. At one point medieval Baghdad found itself simply with no poor on which to spend it's Zakat, so evenly spread was the wealth. All of this without interest-bearing finance...

That being said, modern "Islamic Finance" is -to my understanding- not Islamic and is merely a recreation of the "triple contract" arrangement the early church devised to allow a backdoor for riba (usury).

There can be no Shariah concerning societal issues like banking without a central Religious/Political authority in the form of a Caliph. The Caliphate has not existed in any legitimate sense since the British Funded Wahhabis fought against legitimate Islamic authority and undermined the Ottoman Islamic Empire. At the same time, the Oxford Salafi movement was busy devising juristic justification to allow Jewish Finance to sink their usurious claws into the Ummah (Muslim community). Without the Caliphate, there is no legitimate enforcement of Shariah

Also, Shariah is 100% holistic, and therefore cannot be taken piecemeal. The prohibition of usurious loans is only lip service when the actual currency loaned is lent at it's inception at interest and is not commodity-based. Islamic finance only makes sense in the context of Islamic marital law, inheritance law, criminal punishment, religious devotion, and social structure. There can be no partial application of Shariah in non-Muslim societies, except for personal practices of behavioral and spiritual devotions.

The Qur'an distinguished between finance and business. Finance only exists to facilitate business, not to be a business in and of itself. That is one function of Islamic government, to establish a currency as a neutral and intrinsically valuable medium of exchange, much as the public bazaar is set up to allow for a truly free

marketplace free from intervention save for the restriction from dealing in prohibited items (alcohol, drugs, usurious loans, prostitution etc). These "Islamic Banks" profit personally from their business, are sanctioned by the cabalist world banks, and make no meaningful change as they would not be allowed to exist in these times if they in fact did make a difference.

Wars waged by Godless Western armies against Muslims at the behest of Sabbatean Bankers should provide sufficient evidence that true Islamic Banking, Law, family structure, social activism, and spiritual devotion is the last remaining obstacle to GLOBAL enslavement to Masih ad-Dajjal, the Imposter Messiah, or the Anti-Christ, but these "Islamic Banks" propped up by major finance houses are merely the red herring to throw true seekers off the scent.

Debra said (October 17, 2013):

I’d like to comment, please, on something found in the comment by Stephen Coleman below. It was this:- “Interest was charged only to cover

administrative costs at apx. 1 to 2%.â€

It was and is wrong to do that. I was fooled for the longest time by that particular lie also.

Interest (or anything interest-like) should never be charged for any reason and the article explained very well why NOT to add a fee

(burden) of any sort above the loan itself:-

“One simple rule of detecting usury in Islamic teaching is that "Any loan that stipulates benefits to the loaner is a form of usury". Most

people borrow because they are in need , and need in itself is hurtful to human dignity. So to force people in need to pay penalties

for their need is the epitome of inhumanity. This banning of the interest mechanism is therefore the cornerstone of Islamic banking.â€

end of quote.

The lender is lending from a (his) surplus. “Administrative costs†is a NWO thought-form that incurs debt right from the get-go and many

have written and explained why this is so. I’d like to emphasize:- "Any loan that stipulates benefits to the loaner is a form of usury".