Libertarians Bite the Gold Dust

August 3, 2013

(Left, Ron Paul advocates gold-backed currency. )

(Left, Ron Paul advocates gold-backed currency. )Libertarian popularity has plummeted

with the price of gold resulting

in a vacuum at the heart of

the "Truth Movement." New

monetary programs can fill the gap.

by Anthony Migchels

(henrymakow.com)

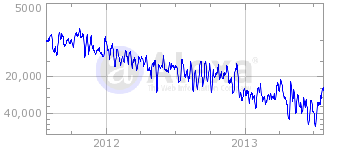

It's hard to think of a more pathetic example of auto-combustion as the visitor decline at Libertarian websites run by Gary North, Lew Rockwell and Mises.org (chart left).

It's hard to think of a more pathetic example of auto-combustion as the visitor decline at Libertarian websites run by Gary North, Lew Rockwell and Mises.org (chart left). Few still believe that Gold will stop the bankers. Gold is deflationary, which would worsen an already grim scenario and does nothing to end usury. America itself is in the absolute worst of positions to go Gold because nobody has any, the Federal Reserve least of all.

Rand Paul recently suggested a Gold commission, but with his father gone, he is useless in the Truth Movement. The only person plugging him is Alex Jones, who was also instrumental in giving Ron 'Arabs did 9/11′ Paul a platform. But just about everybody has been distancing themselves from Alex Jones. In the last few months, many people called him out for different reasons. Jones is regularly being torched by his own feed-backers.

Rand Paul (left) looks increasingly ridiculous. The other day, hard-core Zionist Rand Paul was calling for war in Syria. Claiming Obama only wanted to fight Assad to a stalemate our man stated: 'I've told them I'm not sending my kids or your kids or any American soldiers to fight for stalemate. When we fight, we fight to win, we fight for American principles, we fight for the American flag and we come home after we win.'

Rand Paul (left) looks increasingly ridiculous. The other day, hard-core Zionist Rand Paul was calling for war in Syria. Claiming Obama only wanted to fight Assad to a stalemate our man stated: 'I've told them I'm not sending my kids or your kids or any American soldiers to fight for stalemate. When we fight, we fight to win, we fight for American principles, we fight for the American flag and we come home after we win.'WHAT DOES IT ALL MEAN?

Austrianism always has been the Money Power's tool to subvert American Populism. Ed Griffin's 'the Creature of Jekyll Island' is the perfect example of how they steamroll any platform for monetary reform by confusing the uninitiated. With the decline of Gold buggery, we see a vacuum right at the heart of the Truth Movement.

The international implications of this trend are hard to fathom. Austrianism fits well with the rise of the Gold backed Yuan. The Euro also was designed to be backed by Gold. Ron Paul never intended to win the elections and Lew Rockwell, right after Paul's legendary backstabbing, claimed he was only there to educate the masses on the wonders of Austrian Economics. So it's not too clear if tPtB want a Gold Standard for America, or perhaps he was just too early.

The Truth Movement is the natural heir of the great American Populists who have fought for plentiful money since the Civil War. But what is the Truth Movement? The great thing is: nobody knows. It's one big mess and everybody associated with it has his or her own particular perspective.

But there does seem to be a certain loose consensus. 9/11 Truth of course. The idea that the world is run by some bankers (Rothschild & Co), that they are trying to establish World Government and that they use wars to create the chaos they need to get there. It despises Zionism and Imperialism. It is more spiritual than religious.

Bankers have bought the entire world by offering bookkeeping services and slapping usury on those with debit accounts. This is called banking and it's the mother of all hoaxes. It's the kernel of the New World Order. They have brought all nations and governments to their knees and chained us to interest-slavery. Money is the only commodity that mankind can create in infinite amounts with the stroke of a pen.

If the results had not been so harmful for untold billions of people, it would have been funny.

MONETARY REFORM URGENTLY NEEDED

The answer is clear: we desperately need monetary reform. With the Gold meme in decline, more serious proposals are finding a platform. There is the American Monetary Institute run by Zarlenga. They managed to get Kucinich on board, who launched HR2990 in Congress. Shortly thereafter he lost his seat, but this was quite a feat nonetheless.

There are the Hamiltonians/Larouchians, for instance with their the United Front Against Austerity. Ellen Brown's Public Banking is also heavily influenced by Hamiltonian thinking.

These proposals certainly are very American and would go a long way. They would end the depression and interest payments by the State.

But they do not solve interest-slavery for the common man. He would still have to go to a bank to pay $300k interest on a $200k mortgage. These proposals also tend to centralize power in Washington and personally I'd like to see more decentralization to the States, cities and towns.

There are also the interest-free crediters. Mathematically Perfected Economy is one example. Hour Money another. Thomas Greco (Reinventing Money.com) is big on Mutual Credit clearing. These proposals all demonstrate a principled stance against Usury, which is absolutely key.

There are also the Europeans, people like Margrit Kennedy and Bernard Lietaer, who are strongly anti-usury, anti hoarding (of money) and promote regional/complementary currencies.

There are also the proposals that I would loosely categorize as 'Chicago Plan'. The AMI is quite close to it. Bill Still has been offering solutions in that direction. Positive Money comes to mind. A weakness of these proposals is full-reserve banking.

And let's not forget Social Credit, which remains a force.

CONCLUSION

With Austrianism facing decimation, a united Monetary Reform platform seems more possible than ever.

Sound money is

1. Interest-Free

2. Stable, no boom/bust cycle, which is a result of tampering with the volume of money

3. Decentralized in the sense that local communities and economies have access to cheap credit

The current proposals show great promise but the finishing touch is lacking. We need a wide scale debate. This will enhance both the proposals and the public interest and understanding.

Banking is One and those that own it are the Money Power. As Michael Hoffman put it: 'If there is a greater evil than the Money Power, than the Bible is lying......To say that the Money Power is at the very top of the evils that we need to work against basically overwhelms people. They want something else to fight.......Freedom from interest on money, is essentially the battle for freedom from the Money Power......We reject the weaponization of the love of money as it is represented by interest on loans of money!!'

This is, and remains, the challenge for both the Truth Movement and the Human Race.

--

Anthony Migchels is an Interest-Free Currency activist and founder of the Gelre, the first Regional Currency in the Netherlands. You can read all of his articles on his blog Real Currencies

Related:

Babylon = Usury! We want Interest-Free Money!

The Ron and Rand Paul Betrayal

How the Money Power created Libertarianism and Austrian Economics

End the Fed: a Trojan Horse destroying the Truth Movement from within

Why Tom Woods is wrong about the Greenbackers

Greenbackers vs. Goldbugs, by Eric Blair (Activist Post)

The Daily Bell calls it quits...

Forget about Full Reserve Banking

BM said (August 5, 2013):

Another solid article from Anthony Migchels. It's good to see the goldbugs on the run, as gold has been a Rothschild/Oppenheimer monopolized, manipulated commodity that has been serving the interests of the elitists, not the people.

It's certainly not the case that all proposed alternative monetary systems are equal. Your reader Robert is right that social credit was "specifically designed for modern conditions": the system proposed by Douglas (an engineer) was specifically designed to facilitate a more harmonious, leisurely society, rather than a debt-fueled, war-stoking rat race. Eastman has done a great job of updating the Douglas model and exposing the Two-Loop treachery that the financial class has been using to store captured monetary energy offshore, collapse the domestic economy, then buy back working families' foreclosed assets on the cheap. Here's a good recent overview:

http://www.abeldanger.net/2013/04/populist-social-credit-thin-air.html

Readers can find related articles (on usury, libertarian fallacies, LaRouchonomics...) in the Monetary Reform archives here:

http://www.abeldanger.net/search/label/Monetary%20Reform